What are the Pennsylvania and Federal Electric Vehicle Rebates?

Great news! Pennsylvania's Department of Environmental Protection has retooled the Alternative Fuel Vehicle Rebate Program to help more working-class Pennsylvanians enjoy the benefits of zero-emission electric vehicles or low-emission vehicles. First, let's review the new changes to State and federal tax incentives for electric vehicles. The recent tax credits can help ease the cost of buying a zero-emission vehicle when combined with state and local rebates.

Do I qualify for the Alternative Fuel Vehicle Rebate Program?

The Alternative Fuel Vehicle Rebate Program is now back and better than ever! The rebate for battery electric cars and trucks is higher, and the maximum household income levels eligible for a rebate are lower. Battery electric cars and trucks qualify for a $2,000 rebate, PHEVs now qualify for a $1,500 rebate, and other alternative fuel vehicles, and electric motorcycles, qualify for a $500 rebate. The rebate amount is now the same for new and pre-owned vehicles. Plus, there is now an additional $1,000 available to applicants who meet low-income requirements. Here is an example of how the rebate could work for you, a family of two with a household income of $69,000 is eligible for a $2,000 rebate for a battery electric vehicle. A family of two with a household income of $35,000 is eligible for a $3,000 rebate for a battery electric vehicle.

How does the EV federal credit work?

The Inflation Reduction Act of 2022, one of the most ambitious pieces of climate legislation in U.S. history, aims to make electric vehicles more attainable. This incentive is not a check you receive in the mail following a vehicle purchase but a tax credit worth up to $7,500. The electric vehicle tax credit, or the EV credit, is a non-refundable tax credit offered to taxpayers who purchase qualifying plug-in electric or "clean" vehicles. The new credit will allow for a maximum credit of $7,500 for new EVs and up to $4,000, limited to 30% of the sale price, for used EVs.

Get paid to drive a Jeep 4xe SUV!

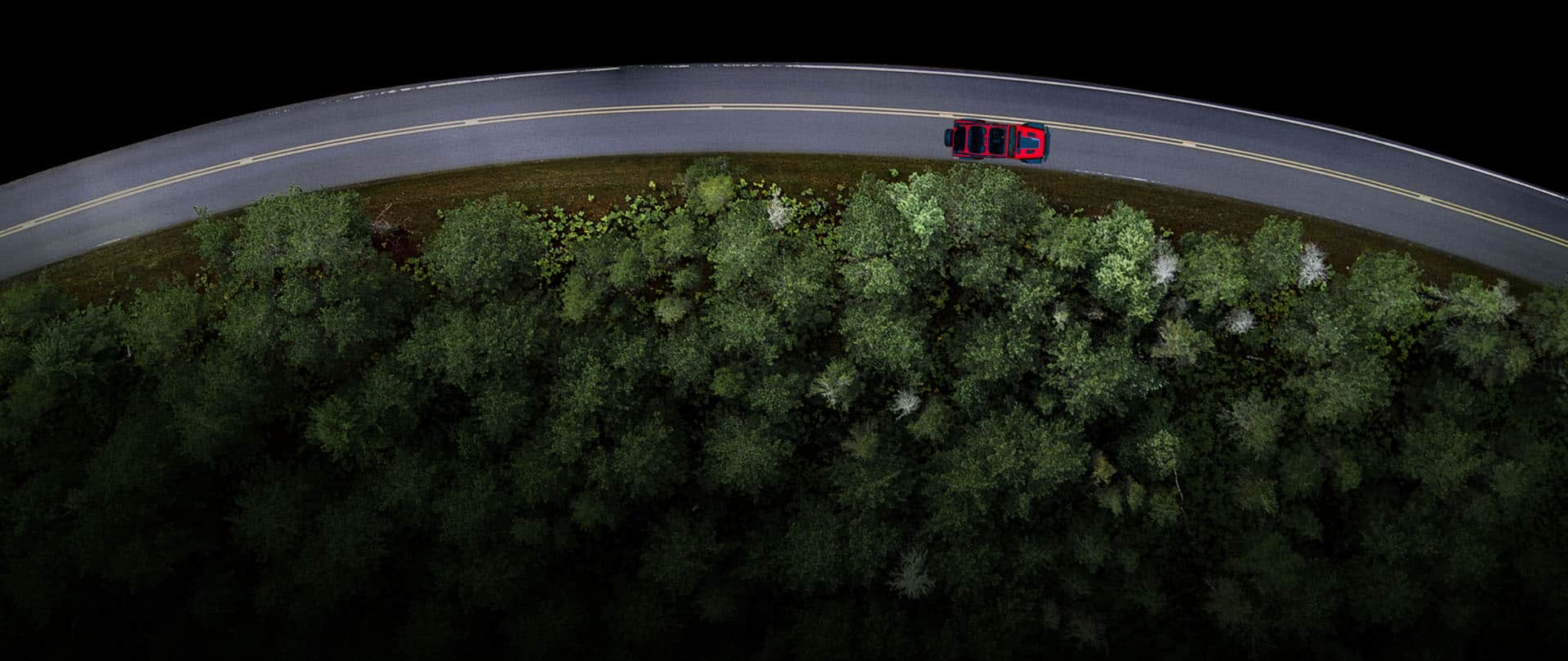

Jeep's 4xe plug-in hybrid powertrain qualifies for both the Alternative Fuel Vehicle Rebate Program and the federal tax credit. This PHEV technology pairs a traditional gas engine with incredible electric motor performance. There's no need for range anxiety when traveling to distant destinations, thanks to the partnership between 4xe technology and the support of your gas-powered engine. Jeep's electrified SUVs also offer near-silent, pure EV-driven performance when in Electric mode. Plus, you can adjust the electric output to suit different driving conditions, recharge and do it all over again.

Save money with Reedman-Toll Dodge Chrysler Ram Jeep Ram!

At Reedman-Toll Dodge Chrysler Ram Jeep, we have taken every measure to ensure our customers receive the very best car-buying experience. We offer many new electric cars, trucks, and SUVs. Our finance team is knowledgeable about the Alternative Fuel Vehicle Rebate Program and the federal tax credit and will happily walk you through the application process. Reedman-Toll Dodge Chrysler Jeep staff will work with you to get you into a vehicle that suits your needs, budget, and style.